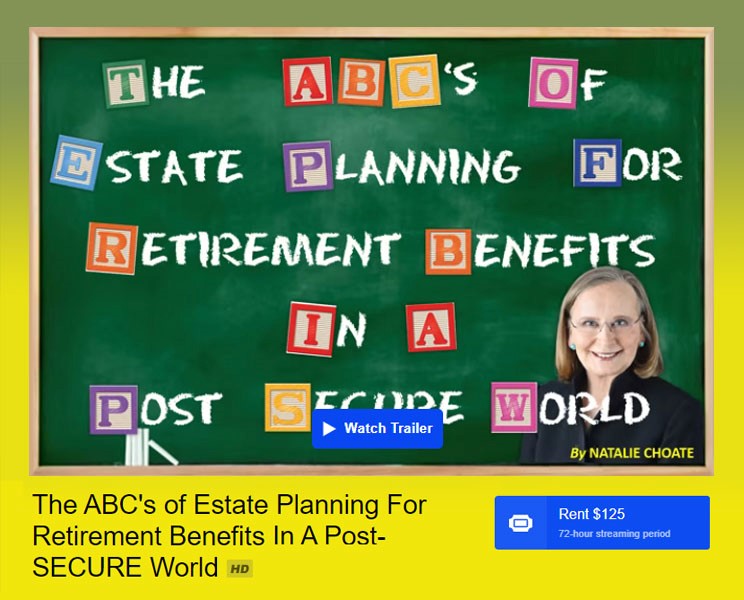

The ABCs of Estate Planning for Retirement Benefits in a Post-SECURE World

Please note: If you are an InterActive Legal subscriber,

please LOG IN for complimentary access to this webinar

Not an InterActive Legal Subscriber? Request a Demo Today.

The SECURE Act has been part of the estate planning landscape for more than a year, but some planners are understandably still considering how (or if) it impacts their clients.

A lack of regulatory guidance has generated further confusion, as professionals try to work within a framework of regulations that doesn’t match the framework of the new law. Add to that a seemingly contradictory IRS publication – which fortunately appears to be an inadvertent error – and it’s no wonder planning for retirement benefits remains a hot topic for discussion.

As we know, the world of “stretch” payouts for all “designated beneficiaries” of retirement plans and IRAs is gone forever, but what does that mean for estate planners and their clients? In order to navigate the complex landscape of this new world, it helps to look at the fundamentals – the ABCs – of planning for retirement benefits. Of course, there is no one-size-fits-all estate plan, so the best strategy for each individual client will vary. Nevertheless, by understanding the rules and how they apply in various scenarios, we can start to understand how to best deal with each type of potential beneficiary.

In this webinar, Natalie Choate breaks it down to the basics – how each possible disposition of a retirement plan works for common beneficiaries. She will explain her A-B-C-D approach to evaluating the pros and cons in typical situations.

Continuing Education Credits

InterActive Legal is not an approved Continuing Education (CE) Sponsor. However, several states and regulatory agencies for a variety of professionals that participate on our teleconferences may still receive continuing education credit for their participation. If a participant wishes to receive CE credit for their participation in these teleconferences, they must apply to receive credit on their own and through their individual states and regulatory authorities. It is the responsibility of the participant to file for CE credit and is not guaranteed by the webinar sponsors.

Speaker