Generation-Skipping Transfer Tax Planning in InterActive Legal

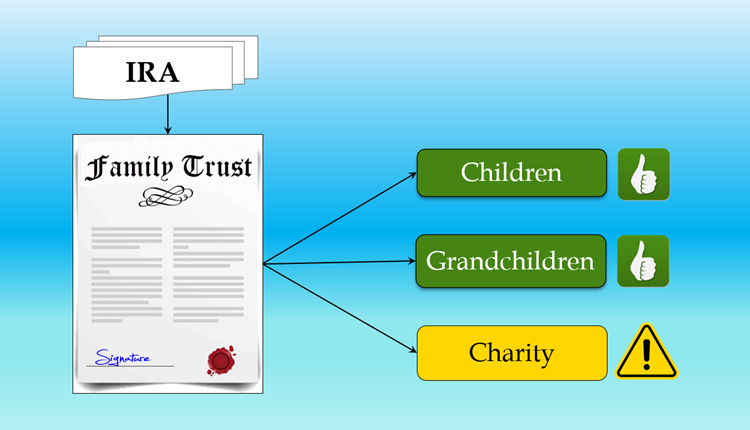

Estate tax planning is top of mind for planners representing high net worth individuals, but planning for the generation-skipping transfer ("GST") tax should also be considered. Many clients - and perhaps some attorneys - may mistakenly assume that the GST tax doesn't matter if property is not being left directly to grandchildren. However, taking advantage of the GST exemption can save millions of dollars in transfer taxation, so clients should at least have the option to build an estate plan that does not waste that exemption.