EVENT CALENDAR

- This event has passed.

WOW Your Clients; Accelerate Their Estate Planning

January 7 @ 4:00 pm – 5:00 pm EST

Announcing InstantPlan by EstateView software, which will be demonstrated Live in an informative Webinar for your team members on January 7th at 4pm ET.

The First Impression is a Lasting Impression.

*Exclusive 30-Day Free Trial for InterActive Legal subscribers

who are not current EstateView subscribers.

Webinar Description

Imagine giving fundamental information to an estate planner, and then hearing back almost instantly with incitement information, customized planning suggestions, and solid analysis, in numbers and illustrations that allow you to understand and go forward with a practical and attractive estate plan?

Not only does your planner get back to you without delay, but this occurs in a manner very much conducive to ensuring that you and your other advisors are all on the same page from an information, planning objectives, and going-forward standpoint.

“Count me in!”

Yes, that is the most common response to the above question. How do I save time, reduce effort, educate my clients, and allow everyone to go forward on the same team, for the same objectives, and with the same accurate information and solutions.

You guessed it—EstateView’s InstantPlan.

Please join Alan Gassman and friends for an informative discussion and live demonstration of InstantPlan, and what it allows an estate and estate tax planner to do for clients, almost instantly.

Save countless hours, and lost momentum, while also having a practical checklist and platform to obtain and share information, practical observations and planning methodology.

InstantPlan will make its formal debut during the Heckerling Institute this coming January, but presently active Interactive Legal and EstateView subscribers will now have Beta access and use of InstantPlan.

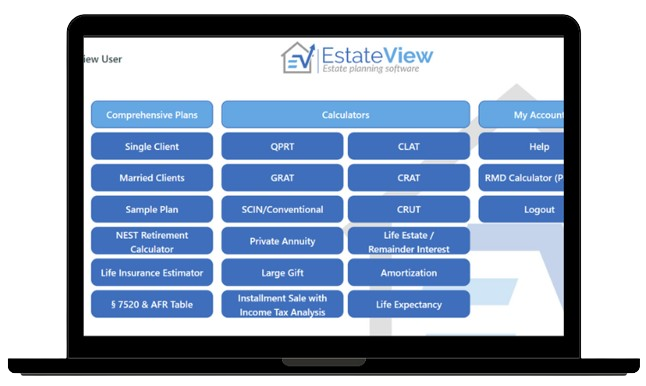

InstantPlan and EstateView work together to enable planners to have over a dozen solid income and estate tax planning techniques and illustrations at their fingertips in seconds.

We hope that you can join us for this informative webinar, which will cover a number of planning discussion points, and deliverables that you can provide for your clients in order to give them a smoother and more productive estate planning experience.

Continuing Education Credits

InterActive Legal is not an approved Continuing Education (CE) Sponsor. However, several states and regulatory agencies for a variety of professionals that participate on our teleconferences may still receive continuing education credit for their participation. If a participant wishes to receive CE credit for their participation in these teleconferences, they must apply to receive credit on their own and through their individual states and regulatory authorities. It is the responsibility of the participant to file for CE credit and is not guaranteed by the webinar sponsors.

Webinar Sponsors

Alan S. Gassman is the founder of the Clearwater, Florida law firm of Gassman, Crotty and Denicolo, P.A., which focuses on the representation of high net worth families, physicians and business owners, and their companies in estate planning, taxation, and business and personal asset structuring.

Mr. Gassman is the lead author on Bloomberg BNA’s Estate Tax Planning in 2011 and 2012, Gassman and Markham on Florida and Federal Asset Protection Law, Florida Law for Tax, Business & Financial Planning Advisors, Eight Steps to a Proper Florida Trust and Estate Plan, A Practical Guide to Kickback & Self-Referral Laws for Florida Physicians, The Florida Power of Attorney & Incapacity Planning Guide, The Florida Advisor’s Guide To Counseling Same Sex Couples, and a co-author of the recently published Legal Guide To NFA Firearms and Gun Trusts, among others.

Mr. Gassman is a frequent speaker for continuing education programs, and has published well over 200 peer reviewed articles with publications such as Bloomberg BNA Tax & Accounting, Trusts and Estates Magazine, Estate Planning Magazine, The Florida Bar Journal, and Leimberg Estate Planning Network (LISI). He is also a past President of the Pinellas County Estate Planning Council and has co-chaired two annual Florida Bar programs for over fifteen years: Wealth Protection and Representing the Physician.

Mr. Gassman holds a law degree and a Masters of Law degree (LL.M.) in Taxation from the University of Florida, and a business degree from Rollins College. Mr. Gassman is board certified by the Florida Bar Association in Estate Planning and Trust Law, has the Accredited Estate Planner designation from the National Association of Estate Planners & Council, has maintained an AV rating from the Martindale-Hubbell for over 20 years and is listed in both Best Lawyers in America and Florida Super Lawyers.

Brandon L. Ketron is a partner at Gassman, Crotty & Denicolo, P.A. in Clearwater, Florida. His practice areas include Estate Planning, Taxation, Corporate and Business Law. Mr. Brandon L. Ketron, graduated from Roanoke College, Class of 2012,B.B.A., cum laude Stetson University College of Law, Class of 2015, J.D.,and cum laude, University of Florida, Class of 2016, LL.M, Taxation. Brandon is also a Certified Public Accountant and is a contributing author of several books, Leimberg Information Services (LISI) newsletters, and Forbes articles