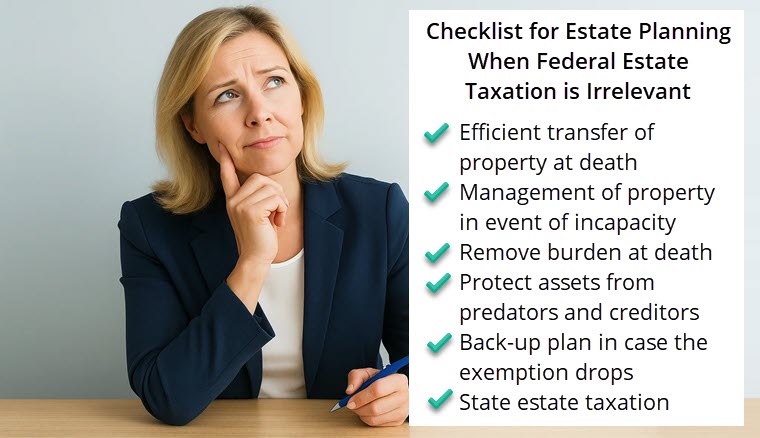

Estate Planning When Estate Taxes Don’t Matter

After years of speculation about what would happen with the estate (and gift) tax exemption, we now have some clarity. Things can always change, but at the moment, federal estate taxation has become irrelevant for most clients. This means estate planning could fall off their radar. Yet even without a tax component, estate planning remains a necessary endeavor for any client who owns any type of property – both to permit the most efficient transfer of that property to the desired recipients at death and to plan for management in the event of incapacity.