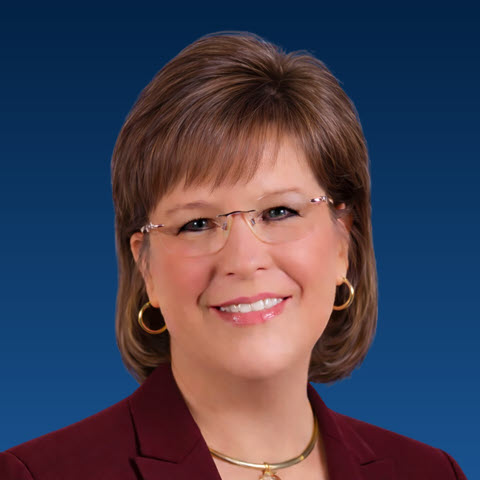

Melvin A. Warshaw, Esq.

InterActive Legal Advisor Emeritus

InterActive Legal extends our heartfelt congratulations to Melvin Warshaw, on his remarkable career and retirement! With more than 40 years of experience in U.S. estate and international tax planning, Melvin has been a guiding force in cross-border wealth transfer for clients around the globe.

From his early days at the IRS to senior roles at McDermott Will & Emery and JP Morgan, Melvin’s leadership and insight have shaped the field. His continued solo practice has supported clients worldwide with exceptional care and expertise.

We’re honored to have worked alongside Melvin and wish him all the best in his well-earned retirement.

Melvin A. Warshaw has more than 40 years experience as a U. S. estate planning and tax lawyer. He currently represents U. S. and non-U. S. high net worth individuals, families and companies on a wide range of personal and business tax matters, especially in connection with cross-border income and estate tax planning and compliance in the U. S. He is admitted to practice in the Commonwealth of Massachusetts in the U.S.

Mr. Warshaw’s legal career has included a variety of different roles in the field of sophisticated international wealth transfer and estate planning. He is a past partner of McDermott Will & Emery’s highly regarded Private Client Department, having established the Boston office practice in 1997. He also served as a senior wealth advisor in JP Morgan Private Bank’s Boston and Greenwich CT offices. He was also formerly general counsel to a large national brokerage that focused on delivering liquidity planning strategies and he has a strong understanding of the array of onshore and offshore life insurance products. Mr. Warshaw began his legal career in the Office of the General Counsel at the Internal Revenue Service National Office in Washington, D.C.

At present, Mr. Warshaw is in sole practice working from his home offices in Wellesley and Stockbridge, Massachusetts. His clients reside throughout the world from India, Singapore, China and Hong Kong to the Caribbean and throughout Europe and in Israel.

Mr. Warshaw is a Fellow of The American College of Trust and Estate Counsel, an Academician of The International Academy of Estate and Trust Law, a Fellow of the Massachusetts Bar Foundation, a longtime member of the American Bar Association Real Property and Probate Section, International Committee of the Income and Transfer Tax Planning Group, a Full Member (TEP) of the Society of Trust and Estate Professionals (STEP), a current member of the Boston Probate and Estate Planning Forum and a current member if the International Bar Association (IBA) Private Client Tax Committee.